2019 Real Estate Forecast

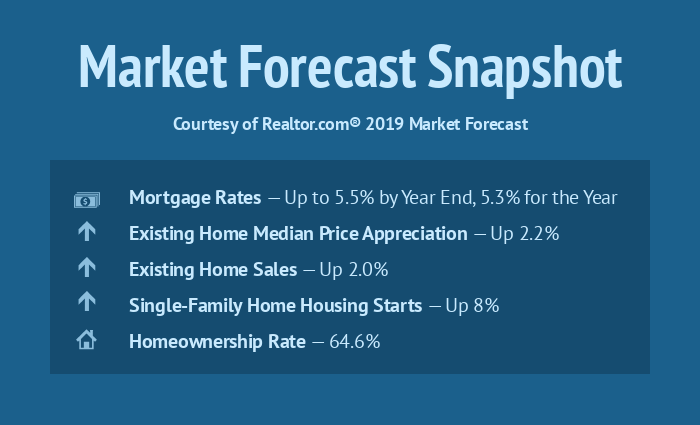

Realtor.com® just released their 2019 housing forecast, outlining what buyers, sellers and homeowners can expect as we say goodbye to 2018 and welcome the new year.

At a Glance

· As has been the case in Seattle over the past few months, home price growth is projected to slow, with a national average gain of 2.2 percent.

· Inventory will continue an upward trend but growth will stay moderate, likely under 7 percent. But high-priced markets, including the Seattle-Bellevue-Tacoma Metro Region, will flip this trend and undergo double-digit gains.

· Millennials will represent the largest number of mortgage borrowers in 2019, at 45 percent.

· The new tax plan will benefit renters but may present problems for some homeowners.

Overall, realtor.com® says the 2019 housing market will be “saner,” in which “affordability continues to play a key role.” And while inventory is projected to increase throughout 2019, market experts say that “unless there is a major shift in the economic trajectory,” they “don’t expect a buyer’s market on the horizon within the next five years.”

Given expected interest rate hikes, purchasing a home will be more of an undertaking in 2019, but those that remain in the market will benefit from less competition yet might feel “an increased sense of urgency to close before it gets more expensive.” As Danielle Hale, chief economist of realtor.com® said in a statement, “unfortunately, it’s only going to cost more to buy, especially in the entry level market. To be successful, buyers should think through how they’ll adapt to higher rates and prices.”

Sellers will need to consider that less buyers will translate to more competition between other sellers, with fewer bidding wars and multiple offers than seen in recent years. But with inventory expected to remain relatively limited, “sellers who price competitively can still walk away with a handsome amount of profit,” just without the frenetic price jumps of previous years.

Top Trends

Slowing Inventory Gains

On a national level, inventory growth will be slow in 2019, at under 7 percent. In most markets, inventory gains can be attributed to slowing sales paces with more new homes being put on the market, but “the inventory increases or slowing price increases necessary for a more widespread sales gain are not forecasted to happen in 2019.” Homes in the luxury sector will veer from this trend, however, and the report names Seattle among the U.S. cities with an expected increase in high-end inventory by double-digits in 2019.

Softening Sales

While 2017 saw the highest home sales volume in a decade, the mild year-over-year decline that will likely be reported for 2018 (based on year-to-date stats) will extend into 2019, with realtor.com® projecting a 2.0 percent decline. The report notes that while “long-term desire to own a home remains strong,” buyers will be forced to reckon with affordability challenges that could lock them out of homeownership.

Millennial Mortgages

As was the case in 2018, millennials will represent the largest segment of buyers in 2019, projected to account for 45 percent of mortgages, compared to 37 percent Gen Xers and 17 percent Baby Boomers. Looking even further forward, 2020 will be the peak millennial home buying year, as a vast number of this cohort will turn thirty, and this demographic is “also likely to make up the largest share of home buyers for the next decade as their housing needs adjust over time.”

Tax Plan Implications

April 2019 will mark the first tax year under the influence of President Trump’s updated tax plan, and the outlook for consumers is mixed. The plan will decidedly help renters, who will benefit from lower tax rates and an increased standard deduction. Homeowners, however, may struggle with limited itemized deductions and personal exemptions, which could translate to a higher tax bill. As the report outlines, “how the market will react [to the tax bill] in 2019 remains a wildcard for housing.”

For more on 2019 housing trends, read the full report here or contact me to discuss the implication for your real estate goals.